Introduction

In today’s fast-paced world of business, financial management is at the forefront of success. For entrepreneurs and small businesses, managing their finances efficiently is paramount. Enter Xero, a game-changing brand that has revolutionized the way small businesses handle their accounting needs. In this article, we will delve into what sets Xero apart in the realm of accounting software solutions, exploring its myriad benefits, key features, pricing plans, and best practices. Join us as we unravel how Xero can be your ultimate solution for financial prosperity.

-

Benefits of Using Xero for Small Businesses

Xero stands out as an indispensable tool for small businesses, offering a host of benefits that empower them to thrive in a competitive landscape. Firstly, automation is at the core of Xero’s functionality. This means that repetitive and time-consuming tasks are handled effortlessly, allowing business owners to focus on what truly matters – growing their enterprise.

Ease of use is another hallmark of Xero. Even those with no prior accounting experience can navigate the platform seamlessly. The intuitive interface ensures that users can access vital financial data with ease, empowering them to make informed decisions swiftly.

Cost-effectiveness is a critical consideration for small businesses, and Xero doesn’t disappoint. It provides access to a robust suite of features without breaking the bank. In fact, Xero offers tailored pricing plans that align with various business needs, making it a cost-effective choice for startups and established ventures alike.

-

Key Features of Xero

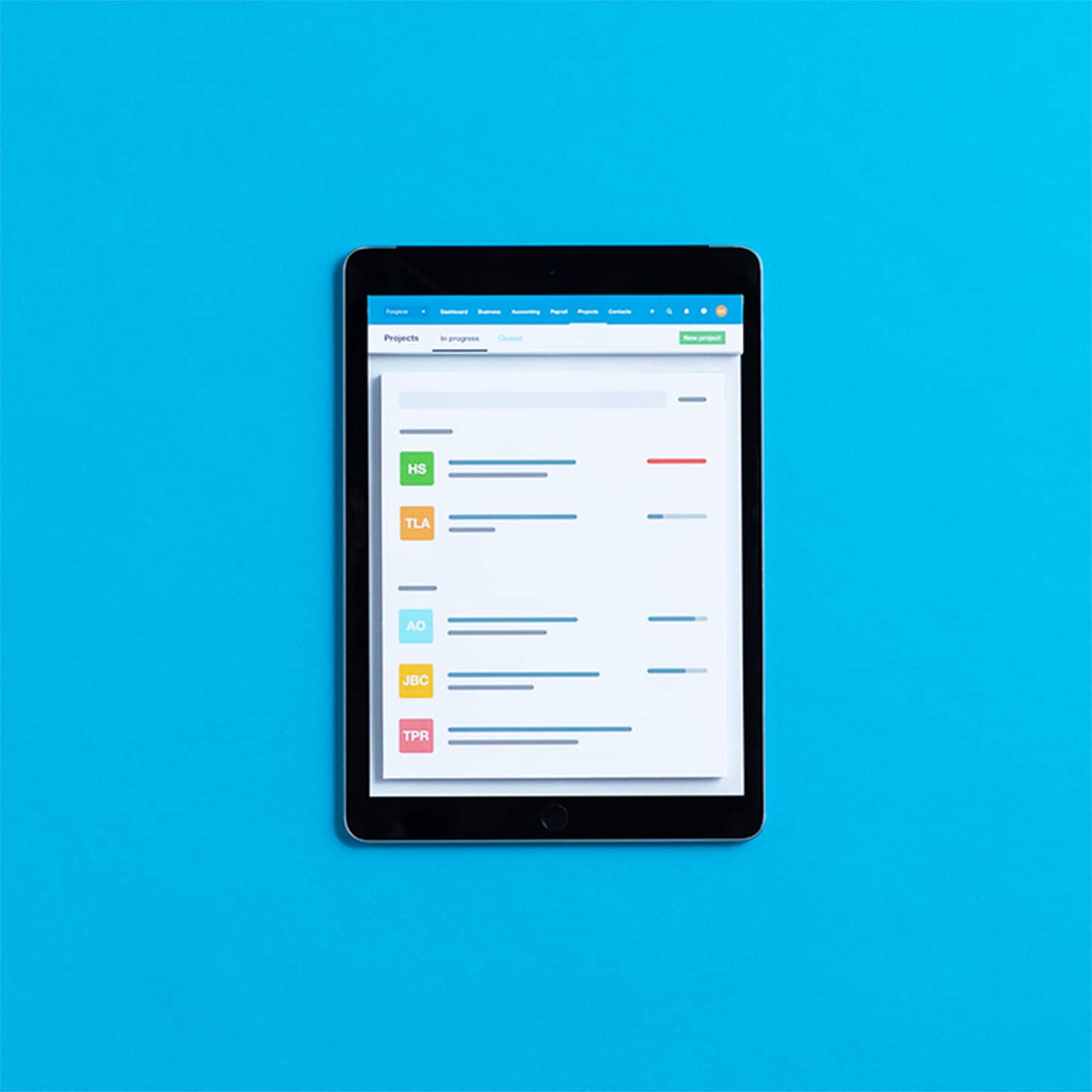

Xero’s impressive array of features covers every aspect of financial management. Their invoicing system streamlines the billing process, allowing businesses to send professional invoices and receive payments effortlessly. This not only saves time but also ensures a consistent cash flow.

Payroll management is another forte of Xero. It simplifies the often complex and intricate process of paying employees, including tax calculations and compliance with labor laws.

Bank reconciliation, a task that once caused headaches for business owners, is now a breeze with Xero. It automates this process, matching transactions with bank statements, reducing errors, and ensuring the accuracy of financial records.

Xero’s reporting capabilities are a game-changer for businesses that thrive on data-driven decisions. The platform generates insightful accounting reports that provide a comprehensive view of the company’s financial health, enabling better-informed strategic planning.

-

How to Get Started with Xero

Getting started with Xero is a straightforward process. They offer a range of pricing plans to cater to the diverse needs of businesses, from sole proprietors to larger enterprises. Whether you’re just starting or looking to scale, Xero has a plan that suits your requirements.

-

Best Practices when Using Xero

To make the most of Xero, it’s essential to follow best practices. Setting up accounts quickly and securely is paramount. This ensures that your financial data is protected, and you can start leveraging Xero’s features without delay.

Tagging expenses properly is another practice that can greatly enhance organization. By categorizing and labeling expenses correctly, businesses can gain a deeper insight into their financial health and make more informed decisions.

Staying up to date with legal requirements is crucial. Xero provides tools and resources to help businesses comply with tax regulations and reporting obligations, ensuring they operate within the bounds of the law.

-

Common Mistakes when Using Xero

While Xero is designed for simplicity and efficiency, some common mistakes can hinder its effectiveness. Neglecting security protocols is a grave error, as it exposes sensitive financial data to potential risks. Always prioritize security measures to safeguard your financial information.

Working without backups is another pitfall to avoid. Data loss can be catastrophic for a business. Ensure you have robust backup systems in place to prevent any loss of critical financial data.

In conclusion

Xero emerges as the ultimate solution for financial prosperity for small businesses. Its automation, ease of use, cost-effectiveness, and comprehensive features make it a powerful ally in the quest for financial success. By adhering to best practices and avoiding common mistakes, businesses can harness the full potential of Xero and pave the way for a prosperous future. Don’t miss out on the opportunity to elevate your financial management with Xero – the brand that empowers your financial journey.